Ventures

Ventures is our premier lending product providing lenders with the ability to handle the bulk of what they are looking for in a lending system. It is a one stop solution that utilizes the initial data entered all the way through the life of the loan.

Loan Processing

Typically a loan begins in Ventures as a prospect where the financials are spread to evaluate the repayment ability of the borrower. A series of screens are then completed to address the borrower’s background, collateral and loan needs. All this information will then flow through to the credit memo, other documents and Etran for SBA lending. Ventures can be used for any commercial loan program and provides the ability to differentiate between programs.

Financial Analysis

- Customize spreadsheets

- Unlimited statement spreads

- Unlimited number of entities and individuals statements

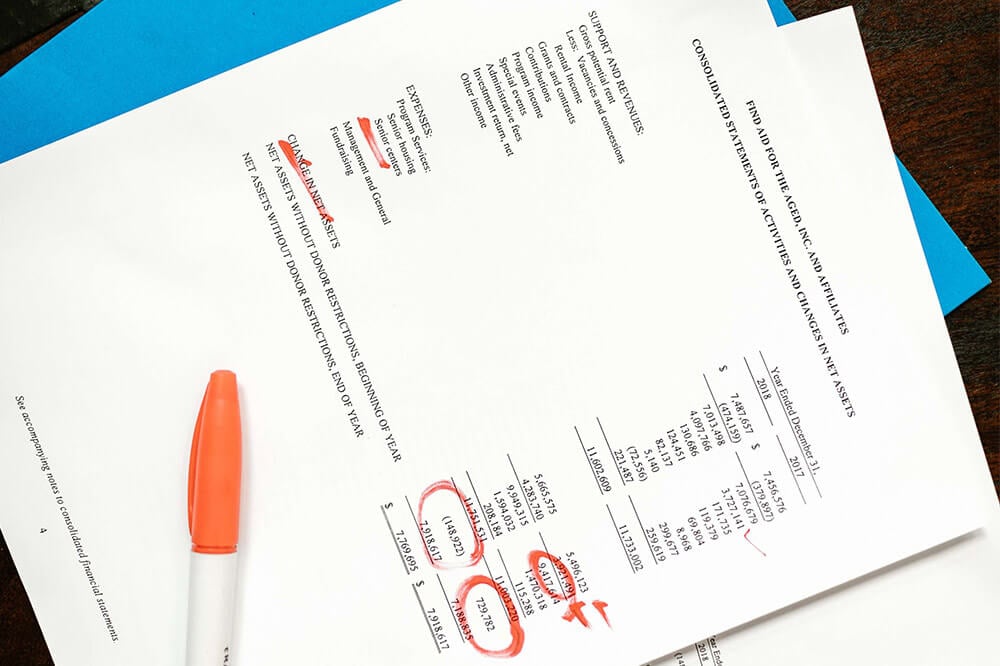

- Consolidated Financials

- Global Cash Flow

- UCA Cash Flow

- Import RMA data for comparison using Estatement Studies

- Automatically calculate borrower's ratios

Customizable Credit Memo

Documents both standard government documents and ability to custom documents

SBA Electronic submission for SBA lending

Pipeline Tracking

Customizable Task List to assign tasks to internal users

Portfolio Management

One of the most vital elements of a loan system is managing the Portfolio. Ventures delivers the tools to track loan covenant requirements, provides tools to standardize and automate a lot of the process and produces system and custom reports.

Covenant Tracking

Ticklers with ability to send emails to borrowers or other contacts for collection of items

Customizable Risk Rating

Customizable Task Lists for tracking processes associated with loan changes.

Ensure steps are not overlooked; and each task within the list can be assigned to an individual or role.

Tracking of loan changes, list of actions are customizable. Some examples include:

- Guarantor changes

- Collateral changes

- Deferments

- Subordination

Spreading of Financial Statements for continued analysis throughout the term of the loan

Optional tax return uploading tool can be added which automates the spreading of tax returns in bulk.

Reports

- Built-in System Reports

- Custom Report Writer

Customize documents by importing from Microsoft Word to create automated merged documents.

What Our Clients Say

"The Ventures product is excellent. Someone with average software acumen can learn it on their own (including custom report writing). Ventures’ customer support is outstanding. The team is knowledgeable, and the response time exceeds my expectations. Their support is among the best I’ve experienced in my career."

Denise Zboralske

Chief Financial & Operating Officer | California Statewide CDC

"As an SBA Lender Service Provider with high volume, integrative software that provides the necessary tools for efficient and accurate application processing is crucial. The platform that Ventures+ offers has been an essential part of our success, and their customer support is excellent."

Susan George

Vice President, Lender Services | Statesman Business Advisors

"Ventures is an easy program to work with. I especially like the variety of reports that can be generated, and tweaked, for the information that we are specifically looking for. They are very helpful if there is an issue or problem."

Betty Rich

Loan Processing Manager | Growth Capital Corp

"Our CDC has utilized Ventures+ services for several years. We have always experienced the BEST customer service. Ventures+ quickly responds to questions or concerns while going above and beyond to insure quality outcomes, program understanding and quality training for their customers."

Melody Harmon

Economic Development Manager | Ark-Tex Regional Development Company

"We used Ventures+ to review Paycheck Protection Program (PPP) applications and submit to the Small Business Administration (SBA). Ventures+ is a great solution because they have a direct connection to E-Tran."

Anthony Giuliano

Sr. Director | Underwriting & Credit Policy Accion Opportunity Fund

"Ventures+ is extremely versatile with great built-in management tools and the ability to easily create your own. Since it’s web-based, the updates are immediate and seamless. CDC Ventures is more than just our software vendor, they are our partner in managing our 504 and Community Advantage lending processes. Their customer service is truly exceptional."

Mark Cousineau

President | Community Investment Corporation

"We were able to process 1,444 loans in nine days. Ventures+ is saving us a ton of time, allowing us to fund more quickly and make our small business borrowers very happy. (in reference to Paycheck Protection Program Loans – PPP)"

Tom McHale

Regional President | Pursuit Lending, a mission-based lender in New York, New Jersey and Pennsylvania

"Ventures+ is constantly evolving with more solutions that help all phases of our loan process. And the customer support is outstanding!"

Evan Shaw

Credit Analyst | Business Finance Group

"Ventures+ is a breath of fresh air in a data driven world. Accessing loan data, moving from screen to screen and completing tasks is extremely easy to do. Ventures+ was created with a primary goal of ease of use while ensuring accuracy and completeness throughout the program. The transition to Ventures+ was seamless and the training was thorough."

Todd E. Kobernick

Attorney, Law Offices of Todd E. Kobernick

.png?width=200&height=87&name=ventures_logo_marketing_site%20(1).png)